Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

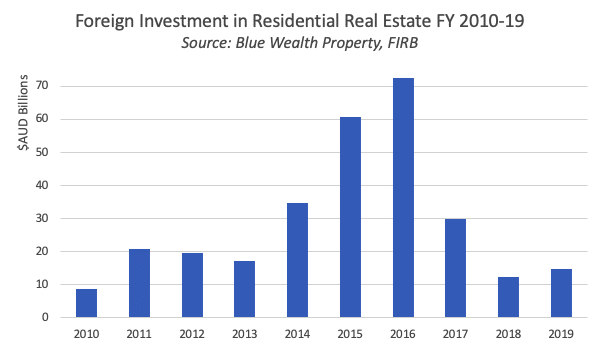

For the last few years, the amount of foreign investment in Australian housing has plummeted. This corresponded with the implementation of penalty duties in every state and territory, which typically deemed an investment unviable. In New South Wales for instance, a foreign investor would be liable to pay the usual $40,000 transfer duty, as well as an additional $80,000 surcharge purchaser duty. This sunk cost is equal to more than 10 percent of the property’s value, an amount that would usually be enough to fund their deposit. With the current duty in place, a foreign investor would need a year or two of strong growth just to recoup their costs.

Implementing surcharge duties for foreign investors, and the subsequent reduction of foreign investment in residential real estate, is appealing to Australians entering the property market. Particularly if it’s their first time doing so. Aside from there being less competition and upward pressure on prices, there is also a qualitative element of properties being better designed with the domestic market in mind. For instance, during the foreign investment boom of the mid-2010s, many property developers tried to cash in by minimising floor space and going cheap on design, leading to ugly and high-vacancy investor stock (particularly in our CBDs). It’s easy to do this with foreign investors because they’re less familiar with how Australians live, and it’s more difficult for them to raise issues with bad craftsmanship. Aside from all that, there’s something a little too 19th century about somebody owning your home from far, far away.

On the other hand, foreign investment did accomplish two significant feats. Although there was plenty of bad housing stock, there was also some good, and it added to the pool of established housing in order to keep up with the demands of our swelling population. It also injected a lot of money into the Australian economy. More than a billion dollars every week, in fact. Although you might scoff at that, assuming the majority of wealth went to property developers and the banks, remember that construction is one of our most significant industries of employment for the Australian middle class… and you likely have bank shares in your super fund.

Coincidentally, the coronavirus downturn followed a period of low residential construction activity. This has seen rental vacancy rates in some of our capital cities plummet over recent years—something we discussed frequently over that time. A prolonged slump in construction could be disastrous for first home buyers once the economy has recovered, as there will be excess competition for a small amount of available new housing stock. This will lead to upward pressure on prices.

Reassessing foreign investor duties could bring billions back into the economy, but that doesn’t mean it’s the right thing to do. If the government pursues an idea like this, it will be important for them to ensure the following: