Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Since the 2020 interest rate drops, speculation has arisen around how and when interest rates could return to an upward trajectory. We haven’t seen this from the RBA since November 2010, but with a cash rate of 0.1 percent, is there anywhere else for it to go?

You might recall that when rates were cut last year, the RBA governor reassured the country by saying they’d be staying that way for the foreseeable future. A matter of years, in fact. Nevertheless, some commentators have speculated that changes in the bonds market and U.S. economy could take the decision out of the RBA’s hands.

Here’s the question: does it really matter if the RBA increases the cash rate?

The reason interest rates are relevant to the house price conversation is that they dictate the monthly interest payments borrowers pay on their mortgage. If interest rates go down when a buyer’s income stays the same (or increases), that buyer has two primary choices: make the same offer on a home or compete with other buyers in the same situation by offering more (since they can afford it). This situation is most relevant when there is more demand (buyers) for property in the area than there is supply (sellers).

If you pay a lot of attention to the research we produce, you might recall our commentary at the beginning of 2020 about the 2019 rate cuts. There were three in total, accounting for 75 basis points. That’s actually more than the 65 basis point decrease in 2020. In total, the cash rate is 1.4 percent (or 140 basis points) lower than it was on 1 June 2019.

Taking that into consideration, it’s important to remember the cash rate would have to increase six times for it to be at the same level it was during the last boom (predominantly seen in Sydney and Melbourne), but why did the boom slow? I‘d argue it was largely caused by government intervention (namely lending growth restrictions and loan serviceability calculations imposed by APRA).

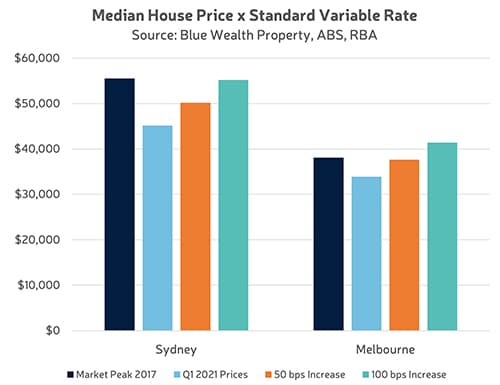

Consider the chart below. The dark blue bars represent the standard variable interest rate amount on the median house price of Sydney and Melbourne during Sydney’s 2017 peak. The light blue represents the same measure in Q1 2021 (lower than 2017, meaning mortgages were more affordable). The orange and green bars represent the amount if interest rates increased by 50 and 100 basis points respectively. As you can see, none of these scenarios reach a level equal to or higher than Sydney in 2017. This means that even if interest rates increase four times, a mortgage is still more affordable than it was in Sydney in 2017.