Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Back in 2014, our research team undertook a field trip to Melbourne in search of competitive markets which bucked the Melbournian trend of undersized and poorly designed homes. One market that stood out to us was Footscray—a suburb many locals overlooked because of its slower rate of gentrification.

Since then, Blue Wealth Property has worked with eight projects in either Footscray or neighbouring Maribyrnong. Although these investments have not yet reached their maturity (being at the most seven years old), the area has delivered investment success to many Blue Wealth Property clients. With the next project in Footscray approaching settlement, now seemed like an ideal time to look at where the market is at.

Coronavirus and the lockdowns

Until the Melbourne-fuelled second wave of coronavirus, Australia was one of the best performing pandemic-era economies. A strong recovery has since followed, but Melbourne’s property market is yet to see the extreme levels of performance as Sydney and Brisbane. For example, although Brisbane’s CoreLogic home price index has grown 13 percent since the arrival of patient zero on 25 January 2020, Melbourne’s has grown 4.9 percent. Still an impressive performance, just not the radical kind.

Rental vacancies and temporary residents

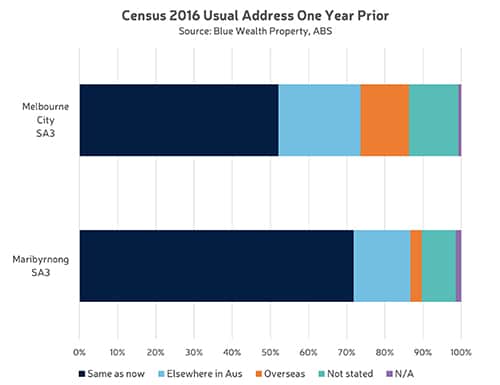

During the pandemic, inner Melbourne’s rental vacancies attracted a lot of attention. According to SQM Research data, the rental vacancy rate jumped from 3.0 percent in March 2020 to 5.4 percent the following month. By October 2020, it had reached a peak of 9.4 percent. The vacancy rate in nearby Footscray also climbed during the pandemic, but nowhere near as high. In March 2020 it was 1.2 percent and peaked at a much lower 5.8 percent in February 2021. The differences could come down to a number of factors, but one that stands out is the difference in the proportion of a transient population. According to the last census, only 52 percent of Inner Melbourne’s population reported living at the same address 12 months prior. In Footscray’s statistical area of Maribyrnong, however, that figure was 72 percent. This means more of inner Melbourne’s population is temporary. When temporary visitors aren’t being replaced with new arrivals (due to border closures and/or reduced domestic relocations), there will be less demand for homes.

Supply of new homes

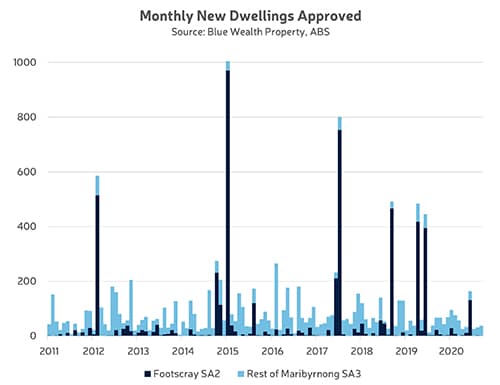

In the past, supply data has been notoriously unreliable. However, the ABS’s tracking of new dwelling approvals allows us to gauge what level of early-stage supply activity property developers and home builders are up to. Footscray saw its decade-high level of new dwelling approvals in mid-2015, with smaller spikes most recently seen in 2019. Not all these dwellings will be built, and those which are will unlikely be built at the same time. The stalling of construction during the pandemic slowed this down further, which actually works to the benefit of property investors hoping to prevent imbalances in the short-to-medium term future.

Sales and price performance

The end of Melbourne’s 2020 lockdown saw a spike in property listings for Footscray, as well as the wider city. Although there has been more stock on market than during the pandemic, the amount of stock taking more than 180 days to sell has been consistently decreasing each month. This means the higher amount of stock on market is more attributable to homes being listed than already-listed homes going unsold. This is good news. According to REA data, Footscray’s median unit price has increased by $26,880 since the end of 2020.