Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

WHAT. A. YEAR.

So here we are at the end of 2020. An emotional and exhausting year to say the least. This time last year, I was more than happy to see the back of 2019. It wasn’t the easiest year for our industry. In 2019 Australian property investors saw APRA’s lending restrictions continue to clobber some parts of the market. We also endured federal election uncertainty and a royal commission which disrupted the mortgage and finance businesses we work with around the country. As has been the case in recent election years, 2019 also saw the reignition of the debate surrounding negative gearing. As I said at the time, those who oppose negative gearing tend to have one thing in common: a lack of understanding of how the property market actually works. It looks like this discussion has finally been put to rest. I believe their position on negative gearing is what ultimately lost them the election. You can click here to read my thoughts on this issue in more detail.

After such a difficult 2019, we were looking forward to 2020 as one of the most promising for property investors in recent years. Little did we know that as we clocked off for our Christmas celebrations in the midst of a horrendous bushfire season, a little-known virus was rapidly spreading through the city of Wuhan in China. A month later, that virus would find itself in Australia. We now know it as the SARS-CoV-2 virus, the cause of the COVID-19 disease which has so far claimed more than 1.6 million lives worldwide. As famously stated by Mike Tyson, everybody has a plan until they get punched in the mouth. For some, 2020’s punch in the mouth was a series of inconveniences and disruption to their way of life. For others, it was far worse. The thoughts of myself, my family and the Blue Wealth team are with everybody who have been affected.

By March 2020, we found ourselves in our first wave and consequentially, our first lockdown. State borders were closed, employees were sent home, flights were grounded, and the federal government racked up record debt to fund initiatives that enabled companies around the country to support their workforce. As we now know, a much larger second wave was soon to follow with its epicentre in Melbourne where many friends, clients, business partners, family members and colleagues of the Blue Wealth team live.

As I was collecting my thoughts for this article, I referred back to a video I recorded in April. In it, I shared my thoughts on what was likely to unfold for the remainder of the year. Without wanting to sound too cocky, I came pretty close! I said the market would go into hibernation, supply would shrink, our nation’s she’ll be right attitude would prevail and government support (such as record low interest rates and fiscal policy) would help the market come out strongly the other side. As far as hibernation goes, we saw dips in sales volumes throughout the country, but especially in our most impacted areas. In the third quarter of 2020 (July to September), Melbourne sold less than half the number of homes than any other third quarter in the last decade. The word hibernation turned out to be appropriate because usually when sales volumes dip, prices do so as well. Nevertheless, the CoreLogic house price index indicates that capital city home prices are now 1.7 percent higher than they were 12 months ago.

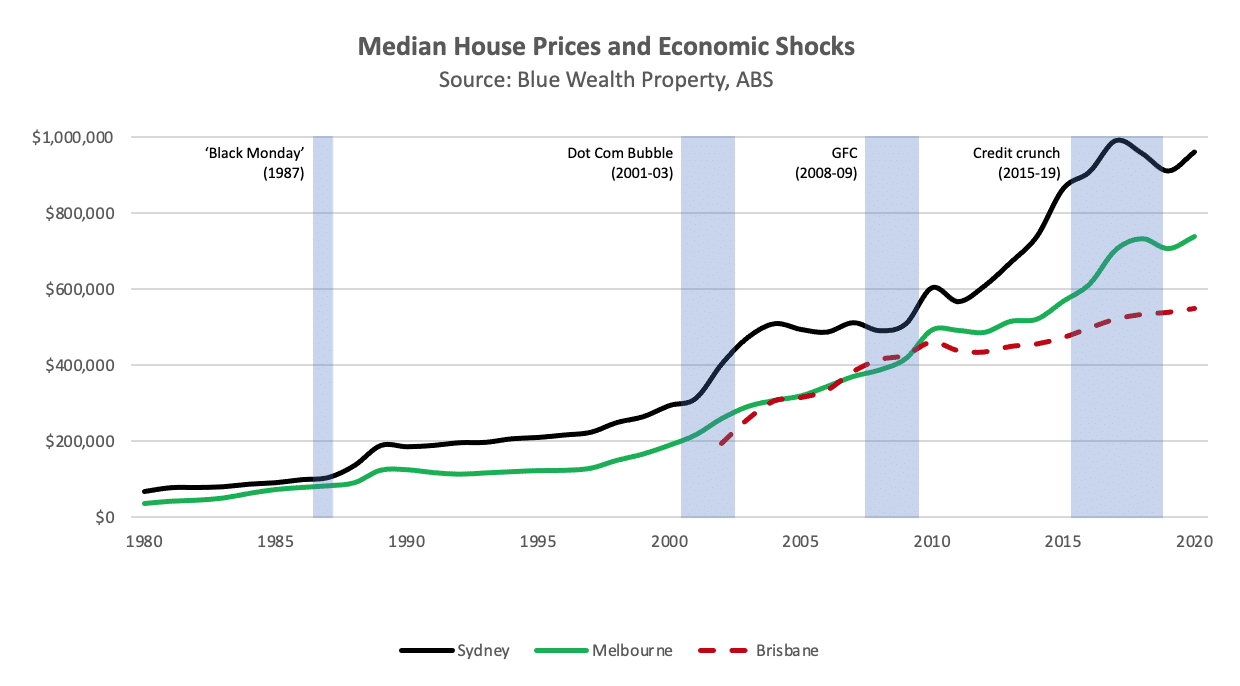

With the benefit of hindsight, a few things became clear. For starters, the steadfast performance of the property market throughout the year highlighted its resilience. Property prices have been strong for my 47 years on this earth and I certainly expect this to continue for the balance of my lifetime (which I hope is a few decades yet). As we emerge from the worst of this pandemic and vaccinate an increasing proportion of the more vulnerable members of our society, property is well positioned to offer unmatched opportunity to investors.

Increases in consumer confidence, a return to economic growth and decreases in the cost of finance are already having an impact on the market, which suggests that 2021 will be a promising year. As I’ve said to many clients and business partners over the year, there will be very few times in your lifetime when you can buy an investment and hold it for nothing. This is the dawn of a new era. Every property our clients purchased this year was positively geared off the back of and low interest rates and strong rents relative to theses interest rates. For those of our clients with equity in their current properties, they can use this equity for a deposit on another property. With positive gearing, this leads to zero net outgoings for the investor for a larger portfolio—something we refer to as Homevesting – buy for nothing and hold for nothing.

In order to fuel economic activity, federal and state governments are continuing incentives for people to buy real estate beyond. New South Wales is proposing a significant change to the way stamp duty is calculated and paid. Victoria introduced a 50 percent reduction to stamp duty for new property. As we reach the end of what has been a difficult year, boom-level auction clearance rates and record growth in mortgage finance are also adding fuel to the fire. We have learned from the mortgage brokers in our network that many of them are busier now than they have ever been in their careers—indicating many Australians can see the opportunity in the market.

12 months ago, 2020 was promising to be one of the best years in recent memory for property investors, but by no means did coronavirus put that to sleep. If anything, the initiatives which emerged from the pandemic will turbocharge the market to a level we wouldn’t have expected before the pandemic descended upon us. For many Australians, the coming year or so will be the once-in-a-lifetime opportunity they’ve been waiting for. I know I’ll be cashing in on it, and I’d encourage you to consider doing the same.

Have a great festive season, unwind, and then recharge for what will be an amazing 2021!