Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

For every opportune property purchase there’s a seller who at some point in the future will no doubt suffer the pain that comes with hindsight. What would induce an otherwise rational investor to sell at the point of opportunity in a property cycle (i.e. a good time to buy/hold)? Discounting forced sales that result from a change of personal circumstances, we hypothesise that sentiment and the economic environment play pivotal roles.

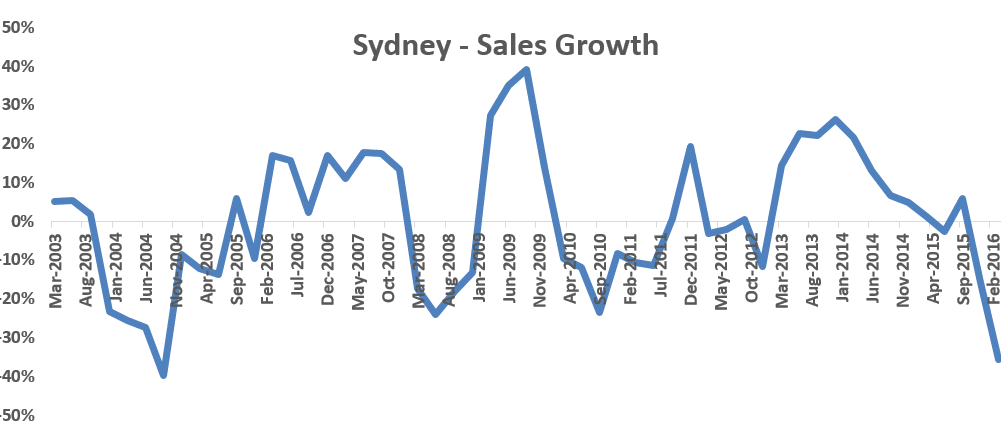

If true, we’d expect a notable spike in sales at times of significant market stress; for example, the onset of the mortgage securitisation induced financial crisis of 2008/2009. The figure below tracks sales growth in Sydney between March 2002 and March 2016 and affirms our hypothesis with growth in sales volumes peaking in 2009.

.

Why is this important? Blue Wealth’s philosophy of counter cyclical investment resulted in the harbour city becoming the dominant market of recommendation in 2009; a point of low market sentiment and, as indicated by the figure, high propensity of fear induced sales activity.

Had the hypothesised impending apocalypse led you to sell property in Sydney in 2009, you would’ve missed out on a growth cycle where the average dwelling price increased by 84.5% (source: 6416.0 Residential Property Price Indexes: Eight Capital Cities). The reality is that market timing is an inexact science and isolating the most opportune point in a cycle cannot be done with certainty. Warren Buffet’s assessment that returns decrease as motion increases is affirmed by Core Logic data that indicates loss making sales are held for on average 5.9 years.

Two lessons: 1) an investment philosophy guided by short term sentiment changes is likely to deliver poor results 2) Invest long term.