Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Hi, Blue Wealth

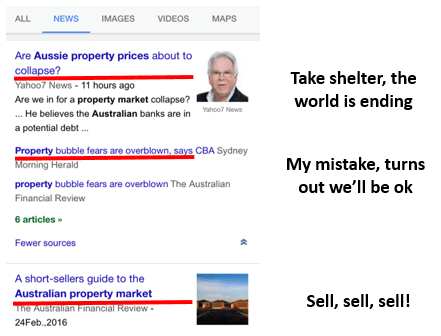

I’m a first time property investor and I’m hoping you can help me out. I’m feeling just a tad overwhelmed; a tsunami of conflicting information is making my investment aspirations look likely to wallow in the too hard basket. Here are just a couple of the unashamedly contradictory headlines of the last 14 days:

There are just a few questions I need answered before I take that leap into property investment. Here goes:

Where should I invest?

Capital city property markets move in non-congruent cycles, so there’s likely always a market opportunity to exploit. Here’s an example:

What this illustrates is that having a one dimensional view of property investment bound by perceived geographical constraints can set you back years in your portfolio building journey. That was a bit of a tangent so to get back to your question, current research approved markets are Melbourne (search ‘Melbourne 101’ in the research blog) and Brisbane.

Should I invest in an apartment or house?

Unfortunately, there’s no short answer. Rather, it comes down to the points I note below:

Location: generally speaking, as you depart from a city centre household sizes and the demand for larger accommodation increases. Blue Wealth is currently assessing both apartment and housing opportunities in our approved markets.

Long term performance: the price movement of apartments and houses in our capital cities is largely consistent, with the most significant difference being that the peaks and troughs of the apartment growth cycle are less extreme than those of the housing cycle. Over the past decade, housing growth has slightly outpaced apartment growth, with the former increasing by 72 per cent and the latter by 66 per cent.

Rent: yields for apartments are approximately 20 per cent higher than those for houses.

Tax: depreciation benefits are likely higher on an apartment than they are for a house.

Maintenance: body corporate fees associated with apartments lead to higher ongoing costs but lower active upkeep than an investment in a house. Account for the opportunity cost of time.

Price: Houses are inevitably more expensive than apartments so, in some cases, there are price barriers to investing in a house.

When should I invest?

Today. ‘The graveyard is the richest place on earth, because it is here that you will find all the hopes and dreams that were never fulfilled… because someone was too afraid to take that first step… or [wasn’t] determined [enough] to carry out their dream. Might be a bit dramatic, but a powerful quote nonetheless. I recall a conversation I had with my grandad before I bought my first property in 2012 in which he did everything but tie me to a chair to stop me from claiming my slice of the Australian dream. Luckily, I didn’t heed the advice. Hindsight, unfortunately, provides no consolation for opportunities lost by inaction.

Ok, you’ve convinced me! Where to from here?

Great! Why don’t you organise a meeting at the Blue Wealth office and we’ll take you through the process in detail.

See you soon.