Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

It’s funny where you can find inspiration. Just last week I was driving through Melbourne’s northern suburbs inspecting a potential project when I came across a sign for a new house and land estate with advertised prices starting at $450,000. I was 30 kilometres from the CBD-that’s about the distance between Parramatta and the city-and in a suburb where the median price was half that of a Sydney comparable! I felt as though I had uncovered a case of potential arbitrage that’d make my finance professor proud.

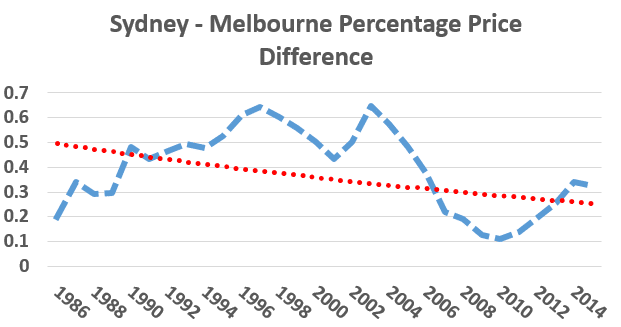

We’ve long recognised the value proposition that Melbourne offers, and this was but another reminder of the potential of the city. Here I was in the most liveable city in the world (for the past six years, mind you), with a population growing at a faster rate than its northern neighbour and in a state with the highest rate of productivity growth. It was difficult to understand why such a price disparity existed; so I thought I’d crunch some numbers. The figure below tracks the difference in price of an average house in Sydney and Melbourne over the past thirty years.

I’ve added an exponential trend line to better indicate how the differential has tracked over time. What we see here is unambiguous evidence of the increasing price convergence of our two most populous capital cities. Over the last decade, the average annual growth rate in the price of vacant land in Melbourne has been twice that of Sydney (6.7 per cent vs 3.2 per cent). The results on a per square metre basis are stronger still, with vacant land in Melbourne having increased 8 per cent per annum over the past decade. With Melbourne tracking ahead of Sydney from liveability, population and economic growth perspectives, the likelihood is that the price disparity will continue to trend downward. Look out, Sydney.