Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

I don’t normally have anything nice to say about media reports on property markets. They’re too often sensationalistic, offer little in terms of balance and would rather stoke fear as opposed to offering truth. The 60 Minutes report on housing affordability last weekend, however, was a refreshing change.

If you didn’t get the chance to see the program, here are the Cliffs Notes:

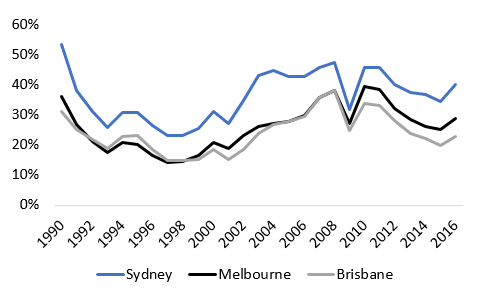

I’d wager the first point would come as a surprise to many Australians. The figure below tracks the percentage of income a household in Sydney, Melbourne and Brisbane spent on mortgage payments between 1990 and 2016. If you owned an average house in Sydney in 1990, you’d spend 53% of your monthly income on mortgage payments. That figure in 2017 is a tick over 40%.

In all eastern seaboard capitals, it was more expensive to hold property in 1990 and between 2006 and 2012 (discounting the post GFC plunge in rates) than it is in 2017.

Source: ABS, RBA, Blue Wealth Property

I’m by no means arguing that it’s now easy to own property. As I noted in point three above, you may need to make sacrifices to enter the property market, both in terms of where you buy and to save for a deposit. Information is power. Get educated, set some goals and take action.